the dumb rich credit card guide part deux

have i completely changed my mind?!

Hey fam and welcome back to dumb rich! HAPPPYYYYY FALL szn!! It all seemed to happen at once. Praise be. No real personal news because we did catch up earlier this week! Only update is I’m watching Gilmore Girls to disassociate from my real life <33

Now, onto Dancing with the Stars being my never-ending source of inspiration. It’s giving me more material for our long overdue post on music publishing and licensing. Apparently, Sabrina Carpenter and Justin Bieber both cleared rights for their songs to be used by OTHER PEOPLE in dances last night. But Lauren from Fifth Harmony basically had a Kids Bop version of her OWN song. How horrific. What an awful way to be eliminated… Why couldn’t she get the rights to her own music? Seems sus. Work From Home is that girl, but the knockoff version was HIGHLY cringe.

Okay, moving on. Tis the szn to be swiping our credit cards. Amex clearly saw the first edition of my credit card guide where I ranked Chase supreme. They decided to increase their annual fee and improve their credit card rewards.

Then Chase saw my post featuring Hailey Bieber on a boat and thought, “Perfect! Let’s make her the face of our rollout.” Wild. After stealing my novel idea, they didn’t even invite me to the launch event with the custom robes.

Okay, so back for round two — perhaps a more fair fight now that both companies have increased their fees and their perks. Let’s get into it.

I’ll start with Amex since the Chase perks remain the same as the first guide.

Amex Platinum - Annual Fee $895 (up from $695)

Alright, I have to say, the new card is chic as hell. The new annual fee stiiiiings. If you currently have a card, the new fee will kick in on your renewal date on or after Jan 2, 2026. Here’s how you can justify the increased annual fee (maybe):

Airport lounges (nothing has changed here) - they do have the Centurion lounge which IMO is nowhere near as nice as the Chase Sapphire Reserve lounges, but there are a lot more of them, so quantity > quality.

Streaming services/digital entertainment credit: $300/year. We have every service under the sun so this is great. This also includes digital subscriptions like NYT, etc. They should include Substack in this so you can become a paid subscriber for free. I am totally fine with them stealing this idea without giving me any credit…

Resy credit: $400/year NEWNESS!! I have no idea how this will work but it is $100/quarter and must be activated. Get on it ASAP.

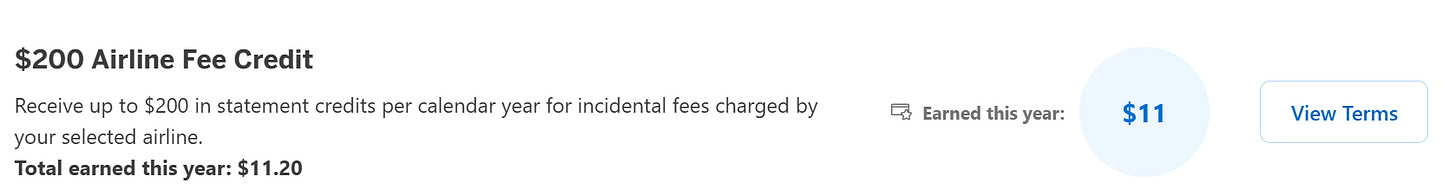

Airlines: $200/year on incidentals (WiFi, checked baggage, fees). Useless. Give me a credit for the actual flight pls. I can’t believe they didn’t change this. Fucking insane?????? I will die on this hill. Amex, get an airline credit or partner ASAP!! Including my family progress for the year just for funsies.

Hotel Credit: $600/year on the Amex Fine Hotels. Great options here. They also often have free nights available.

Equinox $300: Annual credit on gym membership. I don’t really exercise (not a flex) but I imagine this is a popular benefit so I’ll include it for the readers.

Lululemon $300: $75/quarter credit. Not my style but still a great perk.

Oura Ring $200: Also not my style, but very much a cool partnership. For people interested in health, the Equinox, Lululemon and Oura Ring credit would nearly cover the annual fee.

Uber $320: $15 monthly plus a $20 bonus in December. I’ll take it!! They’re also covering Uber plus for $120/year.

Clear Plus $199: Typically, I don’t think the travel service credits are worth it since they’re renewed every five years, but THIS deserves a bullet point. LOOOVE Clear Plus.

Saks $100 gift card: $50 2x/year. Buy makeup. Buy a candle. Buy something totally overpriced and have this cover the tax. Just use it. Everyone always forgets.

Their other benefits that aren’t exactly notable but I’ll include for completeness include a $300 toward the Soul Cycle at home bike (does this still exist?) and a Walmart+ membership (seems incredibly off brand???).

Honestly, they realllyyyyy brought their A game. Big time. The benefits I’d personally use are over $2,000 per year and I’m the perfect combination of picky and lazy! If you maximized all of the benefits, it’s over $3,500.

Breakout of Points:

5x on flights and hotels booked through Amex Travel

1x on everything else

Chase Sapphire Reserve - Annual Fee $795

Now onto Chase. This is from my previous post since nothing has changed. Okay, obviously the annual fee sucks when you have to pay it. Below are their most enticing perks (IMO):

Airport Lounges (non-monetary): Their new lounges are a viiiiiiiiiiiiiibe. Swag bags, waiter service, massages, curated menus. I almost left my husband over his insistence on the Delta Lounge (it was closer to the gate) — where the “perk” was a Nathan’s hot dog cart.

Annual Travel Credit $300: Auto-applied to flights, hotels, Ubers, whatever. Easy win.

Stubhub Credit $300: This is new. You can get $150 for each half of the year, so annoying you can’t use it at once. You also have to remember to activate it, so this is work on your end.

Lyft $120: $10/month automatically to use on Lyfts. I am an Uber girl but still sharing with the class.

Hotel Credit $500: Also a half year credit so you can get $250 twice a year if you book through the Chase Edit.

Doordash: Annual subscription of $120/year and up to $25/month in promos

Dining Credit $300: Another half year credit ($150 2x per year) and needs to be used at Chase’s Sapphire Reserve Exclusive Tables. I though this would totally suck but some of my favorites in NYC on the list are: Frenchette, Don Angie, Nami Nori, and Little Ruby’s (idc if it’s basic).

Shop Credit $250: The Shops at Chase is their newer marketplace where you can shop brands directly. I had never seen this before so I looked into it on my portal. Some of the brands include Aesop, Boll & Branch, Coach, Dyson, SMEG, Therabody and Vitamix. Obviously a limited list but not terrible. I was planning on getting this red light mask anyway. I will look into this for strictly research purposes, obviously.

Apple TV/Apple Music: Apple TV = yes. Apple Music = unsubscribe immediately. Spotify supremacy forever.

Other smaller perks: $120 TSA/Global Entry credit (every 4ish years, so meh), $120 Peloton credit (are we still doing this?), and extra perks if you spend over $75k annually.

SUPER quick points rundown because this is getting lengthy:

8x points on all travel booked on Chase portal

5x points on Lyft

4x points on flights/hotels outside of Chase portal

3x points on dining

1x point on everything else

In summary, the benefits bulleted above are in excess of $2,000, which exceeds the annual fee — plus you can use the points you’re earning toward travel, cash back, you name it. This seems like a no brainer. Also, a hot tip if you are in Chase Private Banking - they have a special silver card that I personally find more aesthetically pleasing! I feel like it carries some serious weight (literally) and people always ask me about it. It’s called the JP Morgan Reserve in case you want to ask your bankers. It has all of the same benefits above (and same fee!) but they also have concierge services for dining, travel, etc.

Okay in summary I am SUPER torn on the Amex vs. Chase showdown round two.

First, points — Chase wins. The points system on Chase is generally more universal, especially for dining. Amex is really just geared toward travel.

Next, rewards — Amex wins. While the Chase perks are great, they are a little bit more niche and require some effort on the user. You need to remember to activate them. Their marketplace has limited brand options. I don’t totally understand the dining credit. And personally I’m an Uber girl. For those reasons, Amex wins for ease of use and more broad categories such as digital subscriptions vs. Chase having AppleTV only.

Tie breaker — Platform use. If you share a card with someone else, Amex is my pick. Chase’s platform doesn’t break down transactions by cardholder (maybe that’s a good thing??), while Amex presents spending data in a super digestible way.

I feel hashtag blessed to be in a two card family because this would be difficult to choose. Reconsidering my life decisions. I can’t believe I broke loyalty so quickly. Who am I?? Chat next week xoxoxo

First, obsessed with this series and love the real time updates. I didn't even know about some of the rewards of my card. However, I am appalled by your quick turn against Chase and your personal attack on Hailey Bieber! Jokes aside, you've inspired me to consider following your lead (always!) and becoming a two card family. But then the total spend gets divided between the two cards, so are you even really optimizing either of them maximally?!

Agreed with other comments. Why choose A or B when you can have both? And in case not obvious expand the width and the depth of the game. Use the right horse/car/card for the right course/track/purchase. Great post and comparison.