Hey fam and welcome back to dumb rich! How the heck are ya??? I miss u!!!! I know, I know… this is entirely my fault. I’ve been seriously slacking in July. But it was my birthday last week—so I hope you’ll let me take (yet another) week off. Please??

Birthdays always bring a little reflection, and I’m super excited for this next trip around the sun. Many, many highlights over the past year. I left my full-time job last July, which somehow feels like a lifetime ago. I also launched dumb rich, which has become the most fulfilling creative outlet. I moved to Brooklyn (now officially my favorite place on Earth) and I just feel extra lucky to have such amazing friends, family, and clients in my corner. This was definitely my best year yet and I’m excited for what’s to come!!!!

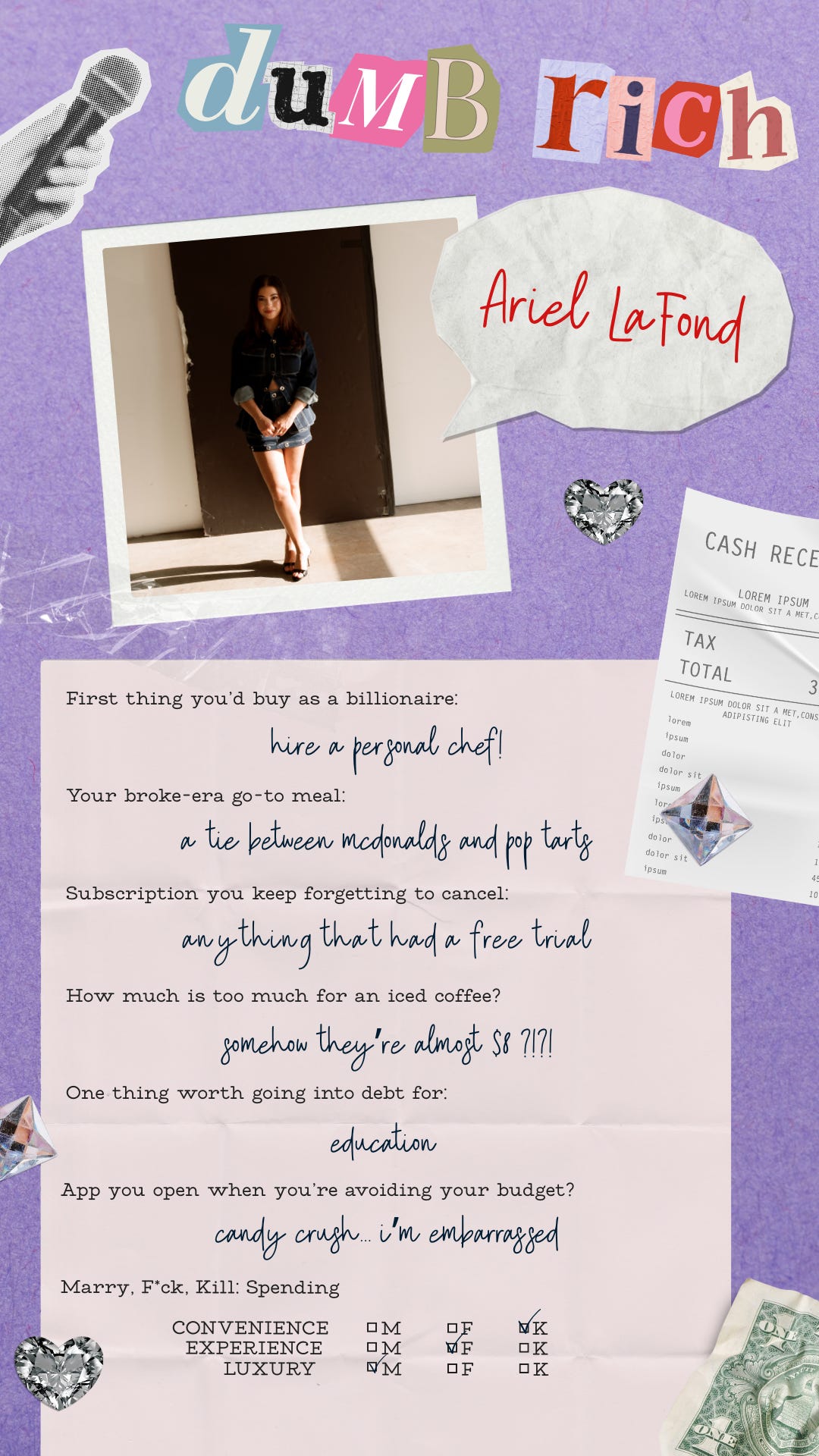

Anyway, you’ve gotten to know bits and pieces of me through this blog—usually via pop culture money rants or actual financial tips. But I figured it might be time to peel back the curtain a bit and give you more of me: who I am, how I got here, and what actually qualifies (or doesn’t?) me to talk about money. I asked friends, family, and clients to submit questions that might reveal some fun facts you don’t already know.

Next week I’ll stop being so self-centered and get back to the money of it all. But for now... ask me anything I missed. Xoxoxo!!

Describe yourself outside the workplace in a cheesy Instagram bio type of way.

New Yorker. Painfully millennial (spiritually Gen Z). Superb emergency contact, emotionally unavailable otherwise. Avid karaoke enthusiast/spontaneous musical break risk. Wife. Rescue dog mom. Lover of all things pink. Never turns down a mirror selfie. Fast food first. Running on iced coffee and gossip.

What makes you think you have the authority to speak/write about anything money related?

I love that the people in my life keep me humble, ya know? Well, I went to Northeastern University in Boston and graduated with a business degree, concentrating in accounting. After college, I then got my CPA license. I interned three times at PwC (a Big 4 accounting firm) and later worked there full-time doing ultra-high-net-worth individual tax—think: mostly billionaires. It was terrifying, amazing, and I weirdly loved it. My PwC friends still joke that I should get the logo tattooed. Whatever lol maybe they are onto something.

Then I moved to a business management firm, where my clients shifted to entertainers and athletes. WAY different from hedge fund guys, but I learned a lot about the entertainment world. From there, I started applying what I knew to a newer class of celebrity: the content creator. I began working with influencers and small business owners, and it took off faster than expected. So last year, I left my job to start my own firm focused on Fractional CFO and accounting services!

Okay, so you mentioned Big 4, but more importantly, what are your Big 3?

Cancer sun, Capricorn rising, Scorpio moon. I think this means I present super put together but I’m constantly depressed? Cool.

What is the worst financial advice you’ve ever received? What is one financial hill you’ll die on?

No one’s ever given me memorably bad personal advice, but the worst advice I do see is all over TikTok and Instagram. So many clickbait-y tax “hacks” that would absolutely get you audited. My clients send them to me all the time. It’s my job to be the buzzkill. Sigh.

The financial hill I’ll die on: it doesn’t have to be complicated. No secret tricks, no “get rich quick” magic. Building wealth is slow, intentional, and often kind of boring. But it works.

So what exactly is your business?

You know those TikToks where friend groups give PowerPoint presentations to explain their jobs? That’s my dream. I’d describe my business as a financial concierge. It has two verticals: individuals/content creators, and small businesses.

For both, the foundation is tax and bookkeeping. I also handle invoicing, bill pay, and all the annoying admin people don’t want to think about. For individuals, I act as the translator between them and their team—legal, wealth advisors, agents, etc.—to create a more holistic experience. I also help with personal budgets, apartment applications, financial docs... you name it.

For businesses, I focus more on strategy: pricing, budgeting, projections, and helping founders stay creative instead of drowning in spreadsheets.

What is your goal/purpose/vision for dumb rich?

I’ve always dreamed of having a blog that answers the money questions my friends text me at 11pm. I even started one pre-Substack called uh huh money (RIP).

Now that my friends and I are in our 30s, we’re navigating careers, families, and real decisions. I realized the financial content out there didn’t speak to us. There’s a gap for those of us that have some disposable income but not an entire team behind us, and that’s the space I want to serve. Dumb rich is about educating that group with zero judgment in a language we both speak.

My vision? More panels, more podcasts, more shit talking on the internet, and maybe even a course. Stay tuned :)

What is the most irresponsible financial decision you’ve ever made?

Literally everyone asked this. LOL. Honestly? I don’t have a single iconically bad decision, but I’ve made a million little impulse purchases. I’m also the worst fucking client. I file my own taxes last, forget autopay exists, never update my own QuickBooks, and sometimes avoid checking my credit card altogether.

I’m just a girl! But it helps me relate to my clients. We’re all dealing with the same shit, just in different fonts.

Show the world Mr. Dumb Rich!!!!

Big reveal…

Also elite segue from Big 4 to Big 3

Obsessed w you and MDR!