a tax checklist for the self-employed

because your CPA is drafting that passive-aggressive email

Hey fam and welcome back to dumb rich. Something must’ve been going on in the universe this past week — I found myself Googling "Is Mercury in retrograde?" more than once. Anyway, big win of the week: I successfully snagged tickets to Beyoncé’s Cowboy Carter Tour. I’m excited to have something to look forward to. Yeehaw!!!

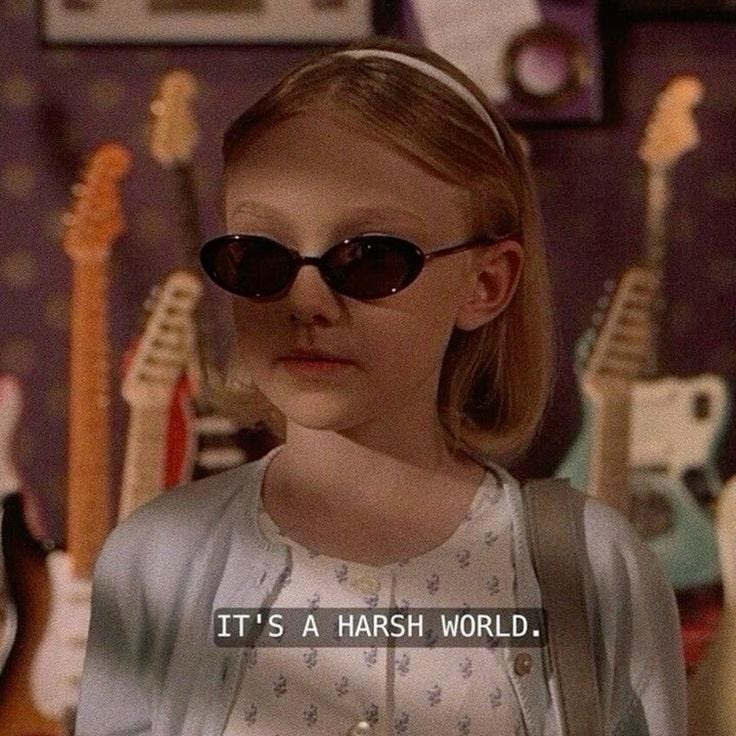

Tis the szn. Everyone is coming out of the woodwork asking me to do their taxes. Hot tip: lose my number (kidding). Today, I’ll teach you how to get your shit together so your CPA hates you a little less. I know taxes aren’t exactly fun. I was going to put a motivational quote here, but I can’t even think of one. Use your imagination. Alternatively, I’ll leave you with some tough love.

dumb rich academy: sometimes being your own boss isn’t that fun

Jokes aside, organizing your tax information for your CPA will likely lead to a better outcome for your wallet—and might even make you a fan favorite with your accountant (#goals). I work with most of my clients on a monthly or quarterly basis, so I get to gather and document the info to my liking throughout the year. These are my personal preferences, but feel free to reach out to your CPA ahead of time to ask what works best for them.

Document Gathering - Save every single item you get in the mail that’s tax-related. They honestly make it easy. Oftentimes, the envelope literally says "Tax Document Enclosed." If you’re self-employed, you’re probably getting 1099s. Go to all your banking and investment portals and check the “Statement & Document Center” for any tax docs to download. Better to send too much than too little. If your CPA doesn’t need something, they simply won’t use it. No stress. And for the love of God, DO NOT send them text message photos of documents you get in the mail. It’s so annoying having to zoom in on your blurry pic with your cat in the background. Just email it, or use a secured folder. Bonus points if you use a scanner app.

Income Tracking - It’s a necessary evil, but also kind of fun? You need to track every penny—whether it’s from your clients, side hustles, or that one-time gig that paid you cash (okay, maybe not that one). You can easily export bank transactions, Venmo history, etc., and add up all the money you brought in. I recommend doing this monthly, just for funsies (though, I get it, not everyone has the same idea of fun).

Business Expenses - Similar to income tracking, keep records of all your expenses directly related to your business. You can also easily export this from your bank/credit card portal. Ideally, categorize these for your CPA instead of handing over 12 months of bank statements and receipts. Examples of categories: travel, dues/subscriptions, professional fees, meals, advertising, education, etc. These will vary based on your specific business.

The classic debate: do you need to keep physical receipts? I tell my clients that for larger purchases, they need to have access to the receipt or purchase history. With most transactions being electronic in 2025, this isn’t super difficult. For example, if you bought a new computer, just move the confirmation email into a folder labeled “Business Receipts” and keep it for possible audits. For smaller purchases, your credit card statements will likely be enough. And if you’re working with contractors, save the invoices in a folder. Seriously though, it’s 2025—consider accounting software.Expenses You May Not Realize Are Deductible

Health Insurance - Yes, paying an obscene amount for health insurance with awful coverage for self-employed people is in fact tax-deductible. Small wins.

Home Office Deduction/Utilities - I’m typing this from my couch. Now my apartment is basically free (just kidding). However, you can deduct a portion of your rent/mortgage/utilities. This is based on the square footage of your workspace compared to your whole home.

Business Gifts - This is kind of a joke because the actual rule is you can only deduct $25 worth of gifts per person. In this economy??

Hiring an Accountant! - CPA fees are tax-deductible too, and they might save you from doing all the heavy lifting and worrying. And we’re cool, I swear.

Quarterly Tax Payments - Keep track of any payments made throughout the year—date, amount, and confirmation. This will help reduce your tax bill come April.

Retirement Contributions - Let your accountant know about any retirement contributions you made throughout the year. In corporate America, this is typically reported on your W2, so I often see self-employed clients forgetting this. Your future self will thank you!

Those are the heavy hitters! Doesn’t seem too bad, right? Plus, it could actually be kind of fun to see how your business performed over the past year. Some CPAs might even help you organize everything further, so you won’t have to do all the work on your own. If you’ve been waiting for a sign to stop procrastinating—this is it.

dumb rich irl: olipop's $1.85 billion valuation: what does that actually mean for you, the investor (or wannabe investor)?

I’m loving Olipop in the adult news and on social media. In case you haven’t seen, they’re clapping back at their competitor, Poppi, for sending full sized vending machines to influencers to post. Naturally, the universe hated this because influencers already benefit from tons of free product, etc., etc. Olipop took to the comments to say that Poppi’s machines cost $25,000 each. I don’t know how valid that is, but way to kick them while they’re down. I found this machine and a few others in the $3,000 price range. However, not everyone is doing their due diligence, and this price tag enraged people even further, making Olipop look like Mother Teresa. Well done, social media manager!

Okay, we got off topic. Olipop could’ve just stfu because they have a much bigger story — their recent $1.85 billion valuation. According to this article, they are also the top non-alcoholic brand in the US. They’re profitable, with over $400 million in sales last year, no annoying vending machines required. So, what does this all mean for it’s recent $50 million of Series C raise?

First off, what is a valuation? It’s a fancy way of saying what a company is worth right now, based on what investors think the future price tag will be. In Olipop’s case, investors see potential growth, revenue, and the fact that people are OBSESSED with gut health (and soda alternatives, apparently). This doesn’t mean they have $1.85 billion on hand, but if someone were to acquire them today, they think that’s the price they’d pay. This also does not mean they are guaranteed to succeed. While the market currently has an appetite for soda alternatives, they may come to their senses and realize fountain soda Diet Coke is far superior.

Olipop is privately held, which means you can’t buy stock on the stock exchange. To invest in private companies like this, you typically need to be an accredited investor or qualified purchaser (aka dumb rich) and have a serious connection. This is a bit more complicated, and for good reason. Private investments are not able to be sold or liquidated as easily. You could have your funds tied up long term, even until the company is sold to a larger entity or goes public.

With private investments, you can’t track how well the company is doing based on stock price. The main way to check valuation is during major events like raising capital. Those who invested in 2021 are freaking out (in a good way). They bought in at a $200 million valuation. Let’s play this out and pretend you invested in 2021:

You, my genius reader, with a bestie at Olipop invested $1 million in 2021 at the $200 million valuation, meaning you own 0.5% of Olipop

You can’t access that $1 million just yet, but no biggie—you’re already dumb rich, and consumers are LOVING soda alternatives (again, no idea why)

The recent $1.85 billion valuation means as a 2021 investor, you have an 825% gain. This makes your $1 million investment worth $9.25 million. Alexa, play Not Like Us.

While you may want to fill bathtubs with cash to celebrate, you can’t yet cash out. You’ll likely need to wait until Olipop is acquired or goes public. There are always nuances to investments, but this is the simplified, likely version. If I listed all the potential outcomes, you’d probably stop reading my blog. Sigh.

shit i want to buy: favorite items i’ve recently purchased

I can’t post a wish list on here EVERY week. People will think I’m totally insane. I don’t have Olipop money. Here a few recent purchases and rapid fire explanations.

Portable scanner because tax szn. Hot take: Ouai hand soap > Aesop. Dad sneakers on my journey to be Gen Z. Sequin skirt because I’m depressed it’s still winter. Sweatpants because I’m depressed it’s STILL winter. When Zara’s good, they’re good. I actually got a blue pair of these sunglasses from The Real Real, but a lot of other great options are available! Gnori plates (didn’t actually purchase YET) to see if Mr. Dumb Rich is still here.

“We did it!” Feeling very Elle Woods these days. Let me know more of what you’re looking for!! Chat next week xoxoxo

all I’ve read is the subject and I already know I’m going to eat this post up

This is helpful! Thanks!!