a lazy person's guide to rich kids

i have this dream my daughter-in-law kills me for the money...

Hey fam and welcome back to another issue of dumb rich! Literally impossible to think of an intro because I am TOO addicted to watching White Lotus and Severance while scrolling on my phone and then missing half the storylines. Highly recommend. Let’s be real — we all just watch TV for the discourse on the internet anyway.

I’m super bummed I couldn’t make Timothée Chalamet’s poker night. For sure wasn’t invited, and I have no idea how to play poker, but it still would’ve been fun to go. Born to go to celebrity poker nights, forced to play excessive amounts of Candy Crush…

Moving on, I saw a lot of people discussing this article from The New Yorker that interviewed 14 New Yorkers who receive financial assistance from their parents. Money is so taboo, I’m literally shocked they managed to get 14 honest interviews. Good on them. I’m still waiting for my parents to tell me I am in fact the Princess of Genovia (glow up included!!). With that in mind, I thought I’d dive into how to receive generational wealth, and if you’re not Amelia Thermopolis, how you can work to create it for future generations (hint: sugar daddy!).

dumb rich academy: let’s create brat monsters with generational wealth

I have a lot of experience with generational wealth, mostly from my first job at PwC. I worked on tax compliance and planning for ultra-high-net-worth individuals, many of whom came from dynasty families. The dynamics there were super interesting—definitely Succession vibes. Who will take over the family business? Can I keep the same lifestyle once my parents' wealth is split four ways? Then split twelve ways among the grandchildren? Should I plan to murder my siblings? What about the one out of wedlock? Coupled with A LOT of pressure to live up to the family name. Studies show generational wealth tends to decline by the third generation, often because of lack of drive or financial knowledge—or being divided among too many heirs.

I’m still hopeful my parents will come through with the royal heir news, but until then, I’m looking into ways to create wealth for my future children. Despite the fact that I don’t have kids yet, I already know that if I have a son, I’ll FOR SURE hate his wife. I’m nervous I’ll end up like the Taylor Swift lyric from my subtitle. Don’t worry, I’ll just stress about this for a while…

Anyway, if the sugar daddy plan doesn’t work out, here are a couple of ways to start building wealth for your children, godchildren, nieces, nephews, etc.! Truly, don’t underestimate the power of compound interest.

529 Plan - Education isn’t getting any cheaper *sigh*. This is a tax-free savings account you can use to eventually fund your child’s college (and sometimes even earlier school) expenses. Here’s how it works: you put money into the account, and it gets invested. The investment strategy is typically based on the "target date" when your child will attend college. The balance grows from those investments, and when you withdraw it, the money is tax-free if it’s used for approved educational expenses (late night pizza is not an approved educational expense). Some states even offer a state tax deduction when you first contribute to the account, so it’s a win-win.

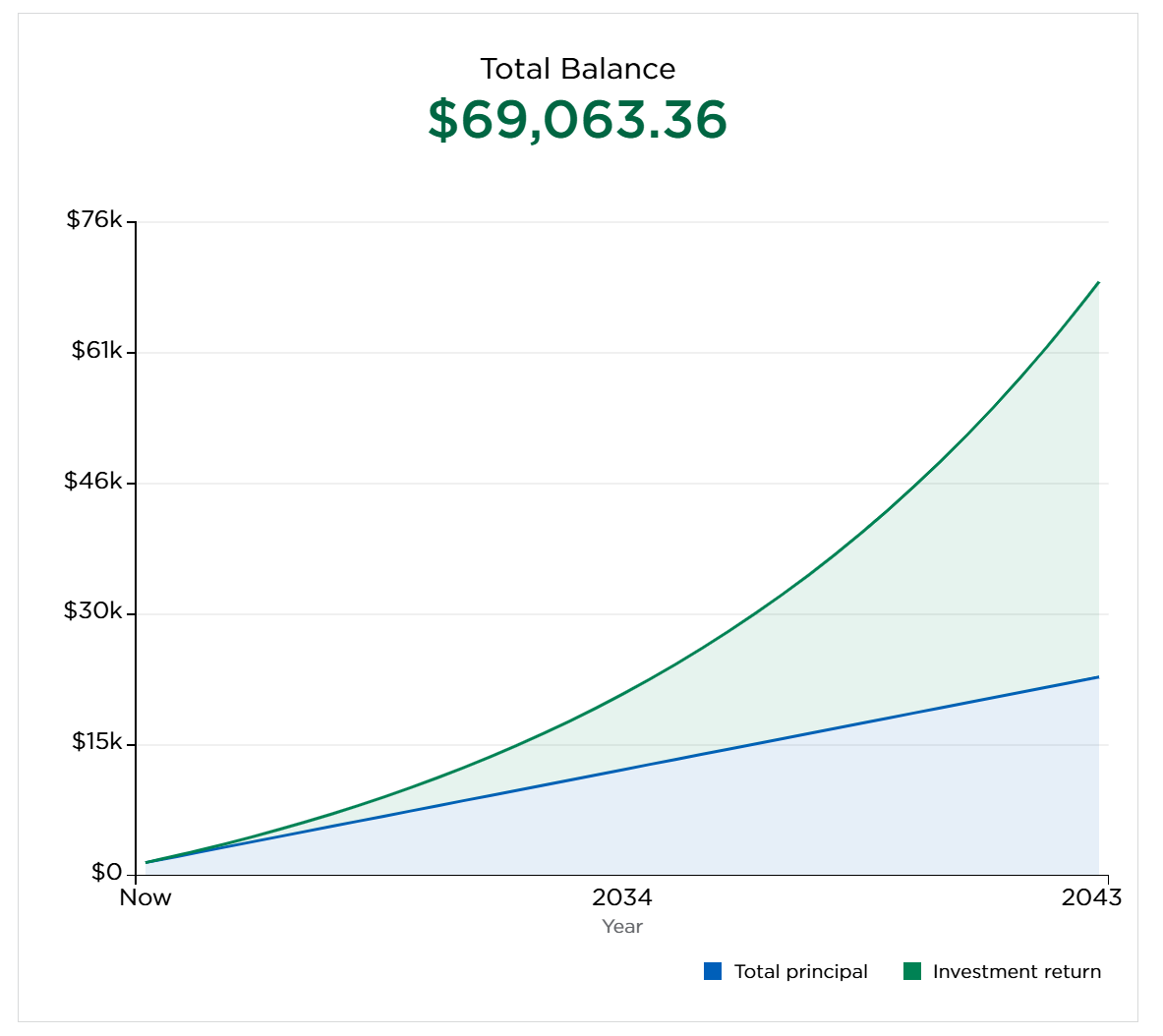

Custodial Brokerage Account - This is just a fancy way of saying an investment account for a minor (a minorrrrrrrr - yes, this is still my entire personality). The earlier you start, the more you can take advantage of compound interest. Let’s say you invest $1,500 to open the account, then invest an additional $100 every month until they’re 18. That’s a total out of pocket of $23,100. If you invest this into a fund similar to the S&P 500 index (which has an average annual return of 10%), by the time your child is 18, they’ll have about $69,000. That’s decent but not totally insane.

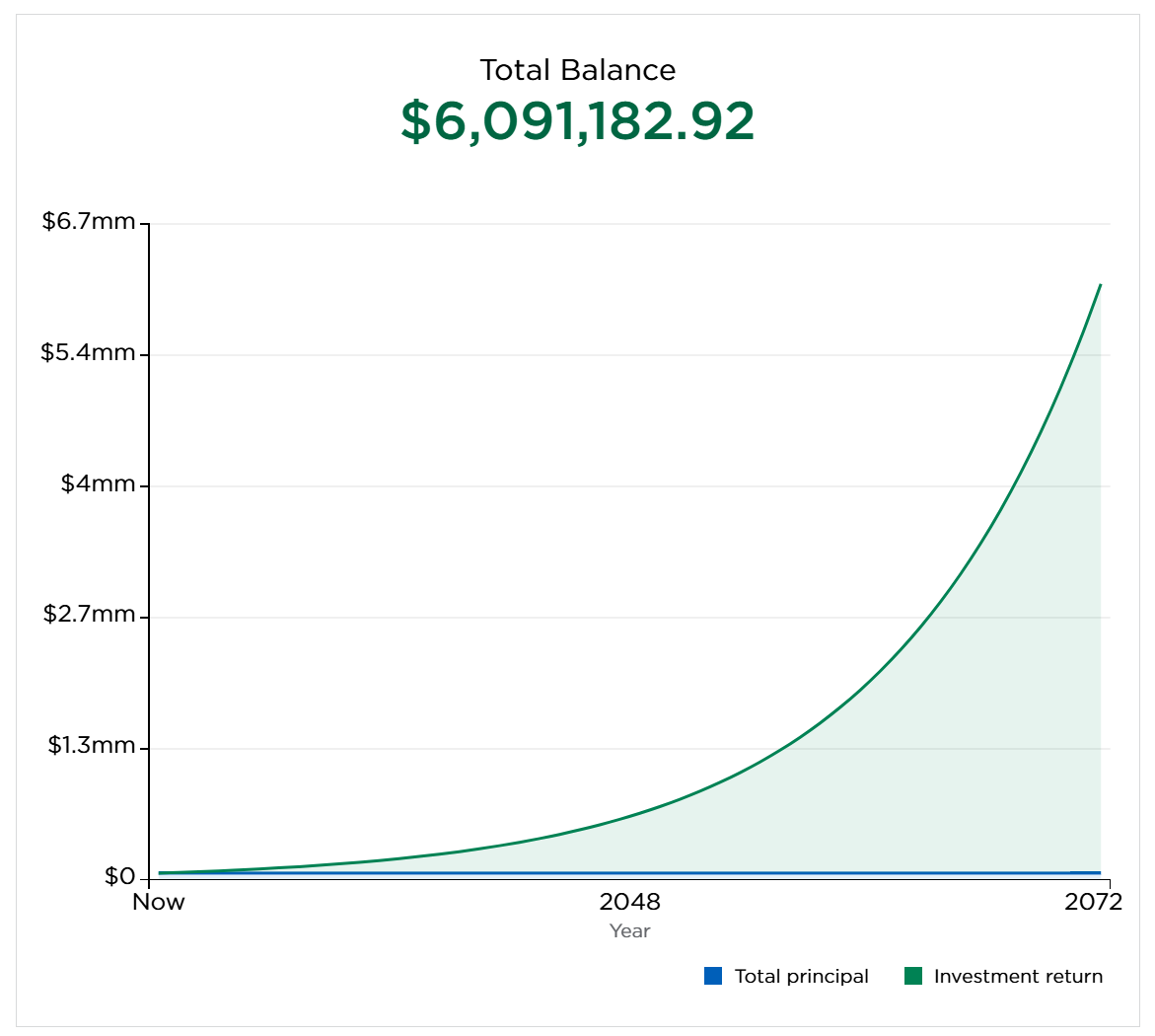

If they hold off on using the money until they retire at 65, they could have about $6.1 million—even if they don’t add another dime after turning 18. All from your $23,100 investment. That’s totally insane. This works for adults too by the way, not just kids!

Both of these are great options and have compounding potential, however the 529 plan MUST be used for educational expenses. My future kids will be getting full scholarships to Harvard, so no need!! The custodial accounts do not have the same tax advantages, but have less spending restrictions.

Now, let’s say you were born into extreme wealth (I’m jealous!!). Even if it’s not extreme wealth, the boomers got pretty lucky… Right now, they hold half of the nation’s wealth. Many were able to build wealth early by benefitting from a hot housing market and having jobs with pensions. Support from families can come in many forms, and no two families are structured the same. Below are two ways you can ask your family for some serious dough:

Annual Gifting - In 2025, you can gift $19,000 per person without any tax consequences to the recipient or the person gifting. If you’re receiving a gift from a couple (perhaps your grandparents), each person can gift $19,000, for a total of $38,000. You can tell them it’s good for their estate planning blah blah. If they give you stacks of unreported cash, don’t tell me about it…

Below Market Loans/Mortgages - Interest rates are next *clap* level *clap* right now. If your family has excess cash, they could buy you a home in cash and create a mortgage agreement where you pay them back (just like a bank). They are still required to charge you interest in order for it not to be considered a gift (per above $19,000 limit), however this interest could make a big difference. For example, if you want to buy a $1 million home and put 20% down on a 30 year mortgage, your monthly payment at a 7% interest rate would be around $5,300. If your family could offer you a 4% rate, your monthly payment would drop to $3,800. Interestingly, last year, all-cash buyers made up over half of the purchases in Manhattan. I think we’re onto something…

dumb rich irl & shit i want to buy: get me out of this cold

I’m still not recovered from last week’s cold front. My senior dog actually has diagnosed depression. We need to get the fuck outside. This really has me focused on my summer travel plans because, duh. I need something to look forward to post-tax season, and White Lotus is sending me to another planet (when I look up from my phone).

I don’t want you to stress—I’m not going all the way to Thailand. I’m probably doing Euro summer (because I’m not that adventurous), but I’ve been getting directed to Thailand thanks to the “White Lotus effect”. White Lotus films each season at a different Four Seasons property. Last year, Four Seasons and HBO officially partnered, creating an exclusive collaboration where everyone’s making tons of money. Great for them, but they were already both dumb rich.

Perhaps more exciting, local tourism is booming. According to the New York Times, there was a 424% increase in sales to the Sicily property after Season 2 of the series aired. Now, just two episodes into Season 3, the Four Seasons Resort Koh Samui has seen a 40% increase in bookings, even at $2,000 per night.

Travel agencies are even marketing White Lotus experiences. American Express is offering a three-night wellness retreat. Going to Thailand from the US for only three nights seems like a commitment. The travel alone is basically a full day. Just going to make this about me — I’m not traveling anywhere that takes a full day to get to at this moment in time. Any suggestions for summer travel spots??

Now back to you, should we go over travel credit cards and which can afford to get us to Thailand first class? Budgeting for a vacation? Let me know!

our hotline 1-800-DUMB-RICH: side hustles

I’ve received quite a few questions about side hustles lately, which I find interesting. We haven’t talked about budgeting yet (stay tuned), but I often encourage people to consider ways to increase their income, not just cut expenses—for the love of God, we’re not cutting the coffee habit.

While I love any questions my readers ask, I feel it would be disingenuous for me to suggest a bunch of side gigs to make extra cash. Sure, there are tons—writing online reviews, dog walking, OnlyFans, selling clothes, etc.

But my entire consulting business and now this blog started off as a side hustle. Both were happy accidents. When it comes to side hustles, I’d say find something you’re genuinely passionate about and build it while you have the stability of a full-time job. You can take more risks, which could eventually lead to more reward. It honestly helps motivate me too. I never set out to start a side hustle (or turn it into a full hustle). I started helping a few entrepreneurs by bartering (or sometimes for free!) and it became super interesting to me. Many referrals and a few years later, it quickly exceeded my full-time job income. Now, dumb rich is my fulfilling side hustle itch.

Many hobbies and interests can be monetized. SO many of my clients started businesses based on their passions, and it turned into a massive moneymaker. I think of someone close to me—a teacher who turned into a highly sought-after tutor. While teachers are woefully underpaid for literally shaping our youth, she left the traditional route and started a super lucrative business charging $$$ for private tutoring. She was able to make her own schedule and choose her own rates. I have so many examples of this. A big part of my job is helping my creative clients ensure their products are profitable so they can focus on what they enjoy doing most! I am a firm believe that when you’re passionate, the money follows.

So, to answer your question about side hustles: figure out what you love. What are you the guru of among your friends? Do people come to you for book recommendations? Get on BookTok. Start a book club people pay $5 to join on Zoom. Is everyone asking you about styling barrel jeans? Start charging for styling sessions or closet cleanouts. Getting paid to shop? Yes, please. Find what gives you purpose and monetize it! This ends my TED Talk (a la Shep Rose), but I’ll dive into budgeting in the coming weeks, which might help in your search for extra cash.

Now I’m dreaming of packing my bags to go anywhere under an 8 hour flight! Let me know what you want to gossip about next week xoxo

ariel, check out the Azores for a shorter travel day to a spring or summer trip from nyc - it's about a 5 hour flight. (hilariously re: the topics of this newsletter - my side hustle is a travel agent!)

also - loving this newsletter, and second'ing ash's idea about a post about how to talk to kids about money!

If I can add, something that costs $0 but will pay untold dividends is TALKING TO YOUR KIDS ABOUT MONEY. I work in the HNW space and I can’t tell you how many g2/g3 folks with gigantic bank account that I see with bad credit because they didn’t you had to pay the credit card bill. Or forgot / didn’t know how to do it. It’s really important to have honest conversations about wealth, money management, etc starting at an early age. Plus spend some time working on your own personal ideas / hangups around money so you can try not to pass them onto the next generation. Making it a taboo subject can create a knowledge gap or worse shame environment that doesn’t help anyone.